Tungsten metal of extreme performance

Tungsten is a rare metal prized for extreme density, very high melting point and wear resistance. These properties make it essential where components face intense stress — from industrial tooling to military and aerospace applications. Tungsten is the metal of extreme performance: density, durability and strategic uses.

Key applications

Tungsten is used when hardness, heat resistance or density matter: cutting tools, PDC drill inserts, industrial filaments, counterweights, kinetic penetrators, aerospace components and power electronics.

| Use / Sector | Concrete example | Why tungsten? |

|---|---|---|

| Machining & tooling | Carbide inserts, cutters | Hardness and wear resistance. |

| Drilling & extraction | PDC drill inserts | Mechanical abrasion resistance. |

| Defense & aerospace | Penetrators, ballast | High density, thermal stability. |

| Electronics & components | Electrical contacts, filaments | Thermal reliability and conductivity. |

| Energy & industry | Electrodes, engine parts | High-temperature resistance. |

Market size & dynamics

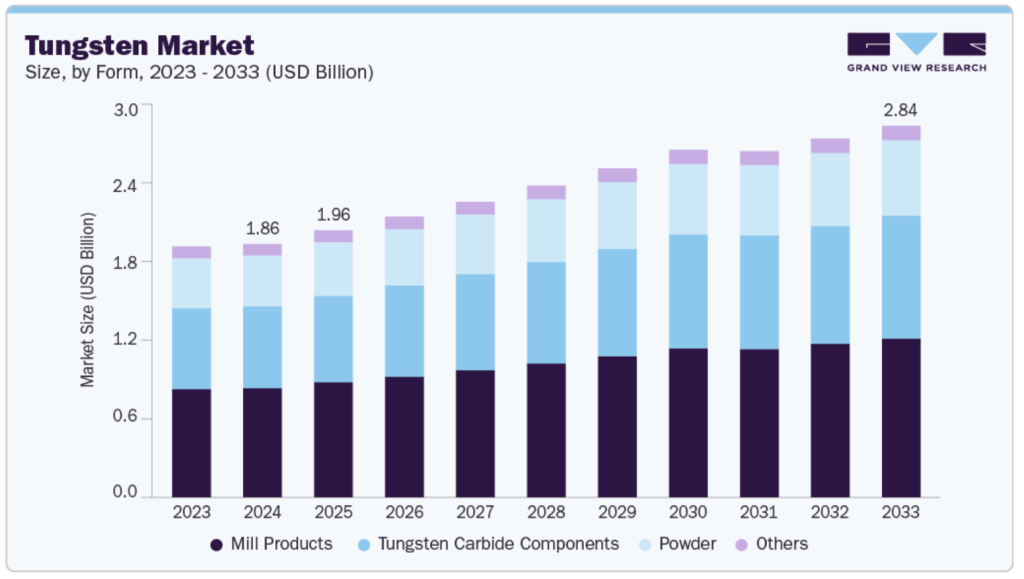

Recent market estimates vary: 2024 market figures reported across reputable sources range (methodology dependent) — some reports estimate around ~1.9 billion USD (specialized tungsten market) while others that include broader downstream products put figures in the ~5–6+ billion USD range; forecasts for 2025 show continued growth (CAGR commonly estimated between ~4% and 8%).

Use the figure that fits your audience and scope (metal-only vs. full-carbide & processed products).

Recent highlights (2024–2025)

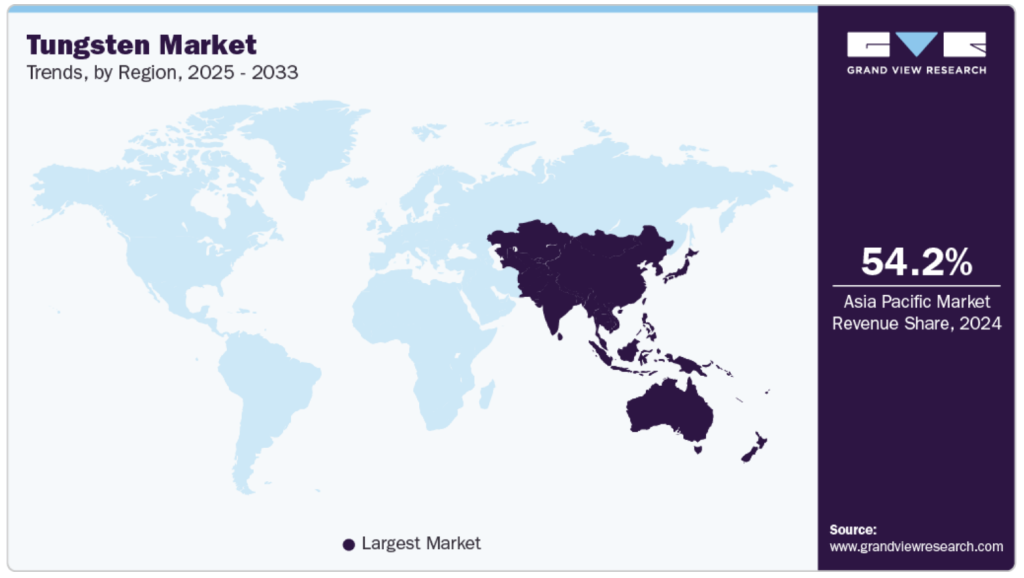

- China produces and supplies the majority of the world’s tungsten (well over 80% in recent years), creating supply concentration risk.

- Export controls and rising military/industrial demand have pushed prices up and renewed interest in supply diversification and recycling.

Leading companies

Miners, processors, OEMs

The tungsten ecosystem includes miners (e.g., Vietnam’s Nui Phao), powder & carbide manufacturers (Kennametal, Sandvik, Global Tungsten & Powders), and Chinese integrated suppliers (Xiamen, Chongyi Zhangyuan, China Tungsten & Hightech).

Building a product or sourcing strategy in a high-demand, geopolitically sensitive market? Let’s craft a supply security plan and market-entry message that turns constraints into a commercial advantage.

Tungsten Market Trends

The North America tungsten industry experienced substantial growth. With the increasing shift towards electric vehicles in the region, the demand for tungsten is also increasing.

In 2024, the U.S. electric vehicle market continued its upward trajectory, with EVs (battery electric vehicles and plug-in hybrids combined) accounting for approximately 8.1% to 9.9% of all new light-duty vehicle sales, up from 7.8% in 2023.

According to the U.S. Department of Energy and Argonne National Laboratory, over 1.3 million EVs were sold yearly, with BEVs representing the majority. The U.S. and Canadian governments are offering incentives to boost EV production and adoption, directly supporting the market growth.

As vehicle production increases, so will the need for reliable, high-performance materials like tungsten.

The U.S. tungsten industry is witnessing robust growth, largely driven by rising concerns over national security and supply chain vulnerabilities.

The country has relied heavily on China for its tungsten needs for years, as China dominates global production. However, geopolitical tensions and the tariff on Chinese tungsten imports have accelerated the U.S. government’s efforts to diversify sources and reduce this dependence.

Measures such as the Department of Defense’s plan to phase out procurement of Chinese and Russian tungsten by 2027 and support for allied mining operations in Canada and South Korea reflect a shift toward ensuring a more secure and independent supply chain.

These policy changes are directly boosting demand for domestic and allied tungsten sources.